If your money order gets lost in the mail, you can often cancel it before it is cashed. To start, contact the issuer, provide the purchase details, and complete a cancellation form. You’ll usually need the receipt or tracking number, along with identification. Once submitted, the provider reviews your request, charges a small fee, and either issues a refund or replacement. If the money order was already cashed, cancellation isn’t possible, but you may request an investigation. Acting quickly improves your chances of recovering funds.

This guide explains eligibility, step-by-step cancellation, and preventive strategies to keep your future transactions safe.

Can You Cancel a Money Order?

Canceling a money order depends on its status at the time of your request. Before beginning the process, it’s important to understand when cancellation is possible, how tracking works, and why timing makes a difference.

Eligibility for Cancellation

A money order can be canceled only if it remains uncashed. Once the funds have been withdrawn by the recipient, the option to cancel is no longer available. This is because the instrument has already completed its purpose as a financial service. At that stage, you may still request investigation, but recovery will depend on fraud verification and cooperation with authorities. If fraud is suspected, the issuer may conduct an investigation. In some cases, reports are filed with federal authorities under the Bank Secrecy Act (BSA), which is the main U.S. anti-money laundering law. This reporting is handled by the provider, not the customer.

How Tracking Works

Most providers give you tools to track the status of your payment instrument. Tracking can be done online, by phone, or in person at an authorized location. You will need the serial number or tracking code printed on the receipt. Without it, the investigation becomes longer and often involves additional costs. Tracking provides clarity, showing whether the transaction is pending, cashed, or flagged for review. These tools support compliance designed to protect consumers.

When Cancellation Is Not Possible

If the money order has already been cashed, you cannot cancel it. Instead, you may request a copy of the cashed instrument. This copy often shows signatures, stamps, or teller information. With this evidence, you can confirm whether the withdrawal was authorized or fraudulent. In confirmed fraud cases, law enforcement may open an investigation, and the provider may file a report.

Why Timing Matters

The window for successful cancellation depends on speed. The sooner you act, the better your chances. Acting immediately reduces the possibility that someone else can cash the instrument. Delays only increase risk, so contact the provider as soon as you suspect loss. You can also learn about your rights in remittance and money transfer to better understand protections available.

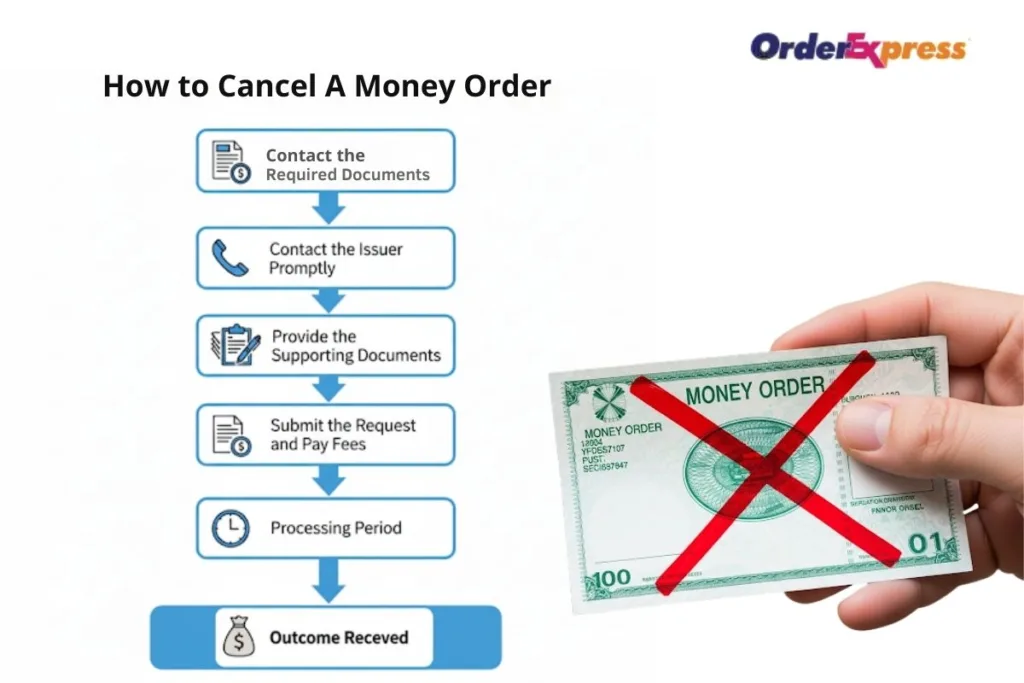

Steps To Cancel a Lost Money Order

Canceling a lost money order involves a series of clear steps. By following each stage carefully from contacting the issuer to submitting documents, you can improve your chances of recovering funds and avoid unnecessary delays.

Step 1: Contact the Issuer Promptly

Call the financial service provider immediately. Explain that the money order has been lost in the mail. Provide all available information such as the purchase date, amount, payee name, and location of purchase. Early reporting demonstrates responsibility and begins the cancellation process quickly. This aligns with consumer protection resources that emphasize timely action.

Step 2: Complete the Cancellation Form

Most issuers require a formal cancellation or replacement form. This form asks for key details, including serial number, purchase amount, and the payee information. If you have the receipt, attach it directly. If not, provide as much detail as possible about the transaction. Inaccurate or missing information can delay processing. Some issuers may require acceptable identification documents to confirm your identity.

Step 3: Provide Supporting Documents

Along with the form, provide documents that confirm your purchase. This could include receipts, invoices, or transaction slips. In some cases, government-issued identification is required. If you are unable to present a receipt, providers may accept other documentation, but the process will take longer. Supporting documents strengthen your claim and reduce the chance of denial. If your transaction involves international transfers, you can also review KYC and cross-border payment requirements for additional context.

Step 4: Submit the Request and Pay Fees

Submit your completed cancellation request through the approved channel. Options vary between providers, some allow digital submissions, while others require mail or in-person filing. Expect a processing fee. Fees are usually lower when the original receipt is included, since it speeds verification. Always keep a record of your fee payment. Fees must be disclosed transparently by your provider. Clear disclosure of costs and timelines helps customers make informed choices.

Step 5: Processing Period

Once the request is filed, the provider begins its review. Processing usually takes 20 to 30 business days, though complex cases can last up to six weeks. During this period, the provider verifies whether the instrument has been cashed or remains outstanding. Investigators may also check for signs of alteration or fraud. Providers apply OFAC sanctions screening as part of their risk-based compliance programs. Screening may occur regardless of transaction size, in line with federal requirements.

Step 6: Receive Outcome

After the review, the provider either approves or denies the cancellation. If approved, you may choose between a refund or a replacement money order. If denied, it usually means the instrument was cashed or insufficient documentation was provided. Even if denied, you may still pursue fraud claims if evidence suggests unauthorized use.

Example Case

Imagine you mailed a $400 money order for rent payment. After a week, the landlord says it never arrived. You immediately contact the issuer, complete the form, and attach your receipt. Three weeks later, the provider cancels the original and issues a replacement, allowing you to pay the rent without losing money. Situations like this highlight the importance of knowing the best ways to send money securely.

Cashed Money Orders: Investigation, Recovery, and Prevention Strategies

Once a money order is cashed, cancellation is no longer possible. At that point, recovery depends on fraud investigation, documentation, and prevention practices. Understanding how to respond after cashing and how to avoid future issues can help you protect your funds.

When Cancellation Is No Longer an Option

If the instrument has already been cashed, cancellation is no longer an option. Instead, you may request a copy of the cashed item. This copy includes signature details and the location where it was processed. Reviewing this information helps identify fraud or errors.

Steps to Take if Fraud Is Suspected

If you believe the payment was cashed fraudulently, act quickly. Contact both the provider and local law enforcement. Provide the copy of the cashed instrument and your original receipt if available. Providers often cooperate with investigators by sharing transaction records. In some cases, issuers are required to file a Suspicious Activity Report (SAR) with FinCEN if fraudulent activity is suspected. This obligation applies to money order issuers as MSBs. Check cashers may file voluntarily depending on risk.

Recovery Limitations

Refunds are rarely guaranteed once funds have been withdrawn. If law enforcement confirms fraud, reimbursement may be possible. However, this process may take months and is not assured. It is always better to act before the instrument is cashed. If you need help, contact your financial service provider for guidance.

How to Buy Money Orders Safely

When buying a money order, fill in the payee’s name immediately. Never leave it blank, as this makes it easier for fraudsters to misuse. Complete all sections clearly. Treat the money order as cash, because it holds actual value. Learn more about other financial practices from your service provider.

Why Receipts Are Essential for Protection

Always store your receipt securely. Consider creating digital copies using your phone or computer. Receipts are the key to faster cancellation. Without them, investigations take longer and fees are higher.

Best Ways to Mail a Money Order Securely

When mailing, choose certified or registered mail. These services provide delivery tracking and confirmation. Place the instrument inside a plain envelope with no labels suggesting money is enclosed. Avoid leaving it in public drop boxes overnight, as theft is more likely.

How to Store Money Orders Safely Before Sending

If you cannot mail the instrument immediately, store it safely. Use a locked drawer, safe, or other secure location. Never leave it in your vehicle, wallet, or open desk. Secure storage prevents accidental loss or theft.

Safe Handling Tips for Money Order Recipients

Recipients should cash or deposit the instrument as soon as possible. Delays increase the risk of misplacement or theft. If immediate deposit is not possible, store it securely until you are ready. If the money order is lost before deposit, notify the sender. The sender is responsible for initiating cancellation, but your cooperation ensures faster resolution. Customers who regularly send or receive transfers may also explore money transfer services for safer alternatives.

Real-Life Scenario

Consider a college student who received a $750 remittance for tuition. They forgot to deposit it for two weeks, and during that time, the instrument was misplaced. The student informed the sender immediately. The sender filed cancellation and, after verification, a replacement was issued. This example shows why quick action matters on both sides.

Take Action Today: If you’ve lost a money order in the mail, act quickly and contact your money order provider immediately.

Conclusion

Canceling a money order after it gets lost in the mail requires quick, precise action. The process starts with contacting the issuer, completing a cancellation form, and supplying proof of purchase. While fees and processing times vary, you can usually secure a refund or replacement if the instrument remains uncashed. If the money order has already been cashed, recovery depends on fraud investigation, which may not guarantee reimbursement. Prevention remains the strongest safeguard, always fill out payee details, keep receipts, and use secure mailing options. Treat every money order as cash, and act promptly if issues arise. By staying proactive, you protect your funds and ensure a smoother, safer financial experience.

For official instructions and service details, always refer directly to your financial service provider.

Disclaimer: This article provides general educational guidance only. Policies, fees, and timelines differ by provider. Always contact your financial service provider for official instructions.

Frequently Asked Questions

Q1: Can I cancel a money order if it was lost in the mail?

Yes, you can cancel a money order if it has not been cashed. Contact the issuer, complete a cancellation form, provide documentation, and pay a fee.

Q2: How long does it take to cancel a money order?

Cancellation typically takes 20–30 business days. Complex cases, especially without receipts, may extend up to six weeks.

Q3: What documents are needed to cancel a money order?

- Original receipt (preferred)

- Completed cancellation form

- Government-issued ID

- Transaction details (amount, date, payee)

Q4: Can I get a refund if the money order was cashed?

No. Once cashed, cancellation isn’t possible. You may request a copy of the cashed instrument and file a fraud investigation.

Q5: How can I prevent losing a money order in the mail?

- Fill out payee details immediately

- Keep your receipt securely

- Use certified or registered mail

- Store the instrument safely until delivery